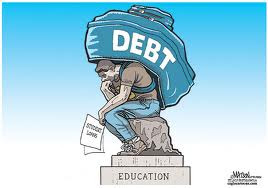

Is this the year you’ll get your financial house in order? Here are nine reasons why this may be the year you take stock finally do something about that debt you’ve been struggling to manage.

1. Eliminate Crippling Credit Card Debt

Are you making the minimum payments on your credit card debts?

Are you missing payments on your credit card debts?

Are you taking cash advances or using your credit cards to pay living expenses like groceries, utilities or even car payments?

Have the credit card companies increased your interest rates?

If any of these is true, it’s time to think about how you’re going to retire that debt. If you’ve looked at how to manage the debt to get it paid off, and that doesn’t seem workable to you, consider filing a bankruptcy case. It may be the only way to eliminate the debt once and for all.

2. Eliminate Unpaid Medical Debt.

Medical debt is one of the major reasons many people file bankruptcy. It’s often not something one can plan for. Even if you have insurance, the co-pays may be unexpected and more than you can handle. You can attempt to negotiate a reduced payment or set up payments, but if you find it a strain to make those payments, bankruptcy might be a viable alternative for you.

3. Get Rid of Bill Collectors.

This is a huge reason people file bankruptcy. They just can’t stand the calls and letters anymore. There are laws designed to protect consumers from unscrupulous collection agents, but those laws are ignored every day.

Even when the bill collectors follow the rules, you still may have too many accounts to manage successfully. Filing bankruptcy will stop the calls and letters.

4. Stop a Foreclosure, Repossession, Garnishment, Tax Levy, Eviction, Utility turn off or Lawsuit.

The same way that bankruptcy stops bill collectors from calling and demanding payment, bankruptcy can prevent a foreclosure of your house, repossession of your car or other collateral, a garnishment of your wages or bank account, a taxing authority like the IRS from taking your property, or a lawsuit being filed against you or continued.

It can also help postpone an eviction or prevent immediate turn off of certain utilities, like water, power or gas. The automatic stay usually goes into effect when the case is filed. Except for some limited circumstances, the automatic stay will prevent or stop all these collections actions from going forward.

5. Include 2015 Taxes in a Chapter 13.

If you owe federal or state taxes for 2015, by waiting until January 1st to file, you should be able to include those taxes in a Chapter 13 case. Such recent taxes cannot be discharged in a Chapter 7 case, but their payment can be managed in a Chapter 13 case so that they are payable over a longer period of time than usual.

6. Purge Holiday Debt.

It’s not pretty, but we know that some people do charge up debt to make their holidays merrier. You have to be careful with this one, however. If you charged debt intending to include it in a bankruptcy case, that could backfire on you. In addition, there are restrictions on the dischargeability of recent debts for cash advances or luxury purchases. You should consult a qualified bankruptcy attorney, who can help you determine the best timing for a bankruptcy after you’ve charged up debts.

7. Manage Old Taxes.

Many old tax debts can be discharged in a bankruptcy case. The rules for determining which debts are dischargeable and which are not are tricky. Timing is often an issue because the dischargeability may be based on when and if returns were filed, when the IRS takes certain actions, and subsequent actions by the taxpayer. If you file your case too soon, before relevant dates and deadlines have passed, you could be forever barred from discharging that tax debt in a later bankruptcy case.

8. Manage Student Loans.

Using bankruptcy to manage student loans can be one of the most helpful reasons to file. Student loans are notoriously difficult to discharge in a bankruptcy case, but filing bankruptcy can help in at least two ways. If you file a Chapter 7 case, you might eliminate other debt, like credit card or medical debt.

You can use those resources to pay student loans. In addition, you may be able to use a Chapter 13 case to force your lender to accept lower payments, at least for the short run.

9. The Stress is Affecting Your Work or Home Life.

Of course financial issues can cause stress. It strains marriages. It causes excessive worry. It can lead to health issues. It can cause you to miss work or even lose your job. Check out these articles to learn more about managing your emotions during a bankruptcy case

Call Firebaugh & Andrews today for your free consultation 734-722-2999