With many people they feel relief after bankruptcy for others they feel a sense of failure. The important part to remember is to look forward in re-establishing your credit

Many suffer from guilt after being bankrupted. They removed themselves from economical outing like going to seminars or auctions or visiting the bank. They thought of themselves as the social outcasts who are marooned on a distant galaxy for not keeping the promise of paying.

But they forget that mistakes make a man wiser by teaching him a lesson; they also forget that past shouldn’t be hold on as they hold back. So being bankrupted is not an end but can be considered as the beckoning to new life. This new life will fill with his experiences and the lessons he had learned or gathered from the mistakes. So he should start afresh again to regain their position, their life and his status.

Monthly Archives: June 2014

Facing Bankruptcy While Living in Michigan

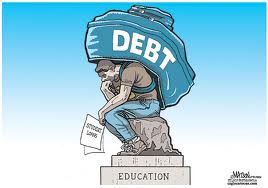

Michigan residents who find themselves overwhelmed with debt can seek relief under the federal bankruptcy laws. There are two common forms of bankruptcy for individuals: Under Chapter 7, the courts sell off all non-exempt assets to pay off as much of your debt as possible and under Chapter 13, you keep all or most of your assets but must create a court-approved plan to pay off your debts over time. Although bankruptcy is handled in the federal courts, some of the details vary based on your being a Michigan resident.

District Bankruptcy Courts in Michigan

Michigan’s bankruptcy court is divided into the Eastern District, with the main court in Detroit, and the Western District, with the main court in Grand Rapids. Each district also has divisional offices where you may file so long as you file in the district where you live.

Can I File Chapter 7 Bankruptcy?

You may file Chapter 7 bankruptcy if your average monthly income for the six months before you file is less than Michigan’s median income for a family of your size. For example, if you are married with two children, you must earn less than Michigan’s median income for a family of four, which is $6,037 monthly for 2012. If you make more than this, you must pass a stringent means test to qualify for Chapter 7.

How Long Is a Chapter 13 Repayment Plan?

The amount of time you must spend paying your creditors also depends on your income as compared to Michigan’s median income. For example, if you make less than the median income, your repayment plan will usually be up to three years. If your income matches or exceeds the state median, your plan will be five years, unless you’re able to pay off all unsecured debt in less time.